There’s a new tool on the Canada Revenue Agency’s website that is leading people to unclaimed government cheques.

Some Canadians have found thousands of dollars they had no idea were owed to them. How? Many people, including a whole lot of creative people, still use their parents address for snail mail while living somewhere else. Sometimes, a letter carrier fails to deliver an envelope. Other times, cheques are misplaced or accidentally thrown out. It’s very possible that a cheque owed to you never actually made it to your hands.

Each year, the CRA issues millions of payments to Canadians for refunds and benefits. These payments are usually issued by cheque or direct deposit if the user has signed up for the service through their account. Government cheques never expire or stale-date, so the CRA cannot void the original cheque and reissue a new one unless requested by the taxpayer.

Want to find out how you can check if any cheques are owed to you?

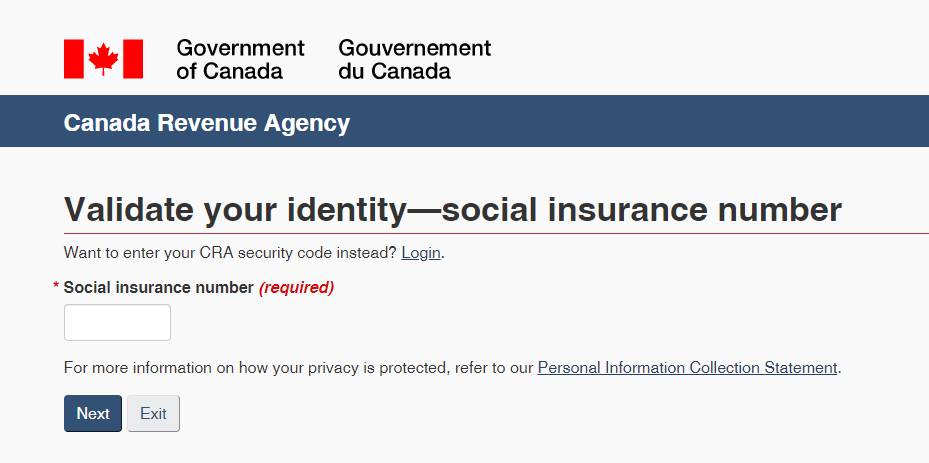

First, you must register for My Account portal within the CRA website, as this will allow you to view and collect any lost cheques from the tax agency, going back 20 years. Before you begin, make sure you have your Social Insurance Number (SIN) on hand, as well as a copy (digital or paper) of your most recently completed tax return.

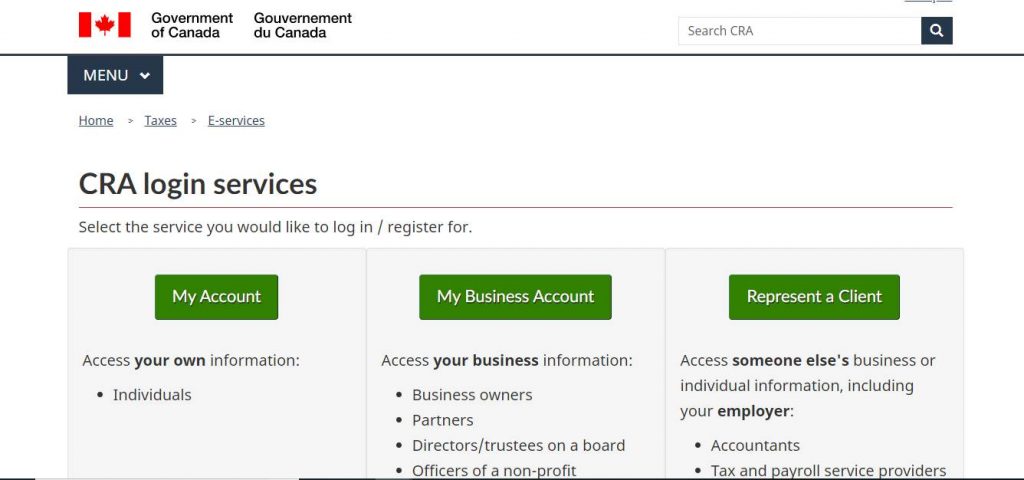

- Click to “Sign in to a CRA account”:

2. Click “My Account”, the service you would like to register for:

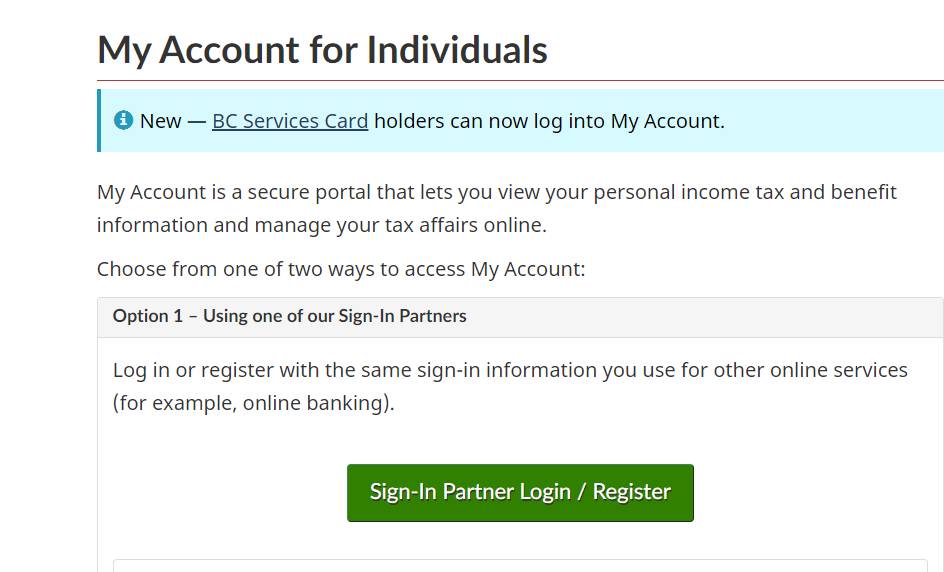

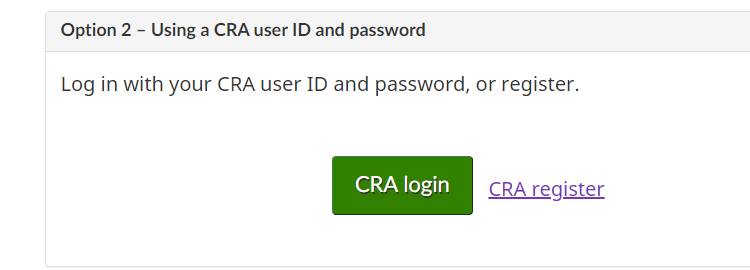

3. Scroll down past “Sign-In Partner Login” to option 2 “register beside “CRA Login”:

4. Time to validate your identity with your SIN :

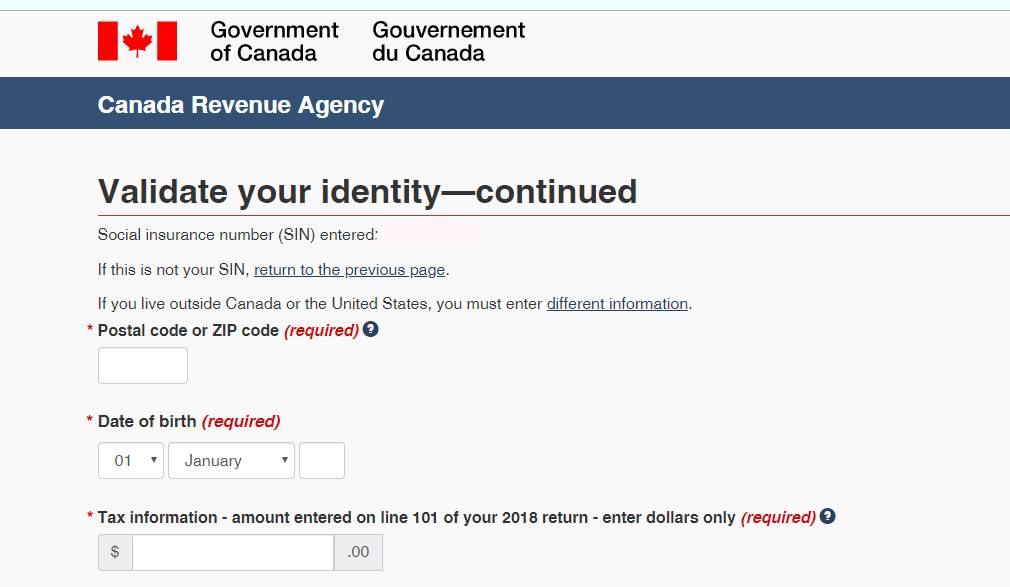

5. Continue to validate your identity by entering your current postal code, date of birth and required tax information from your most recently completed tax return.

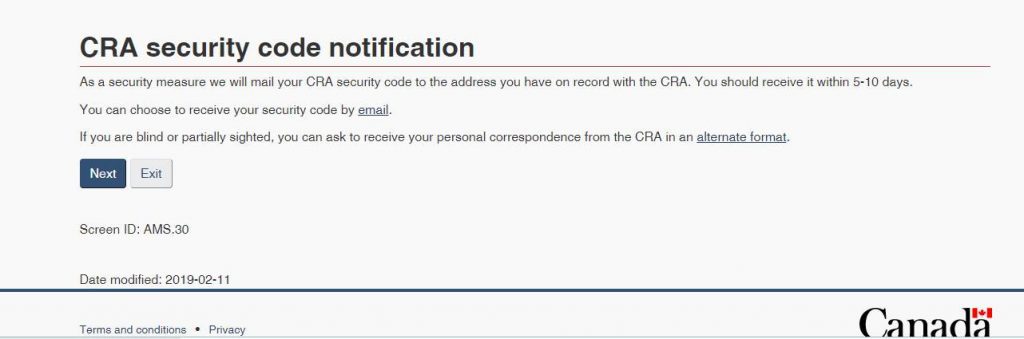

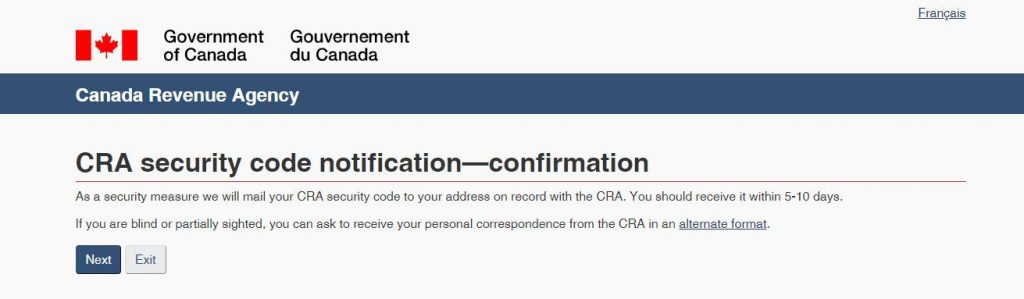

6. The CRA will snail mail you a security code to the address they have on record. It should arrive within 10 days, or you can choose to receive your security code by email:

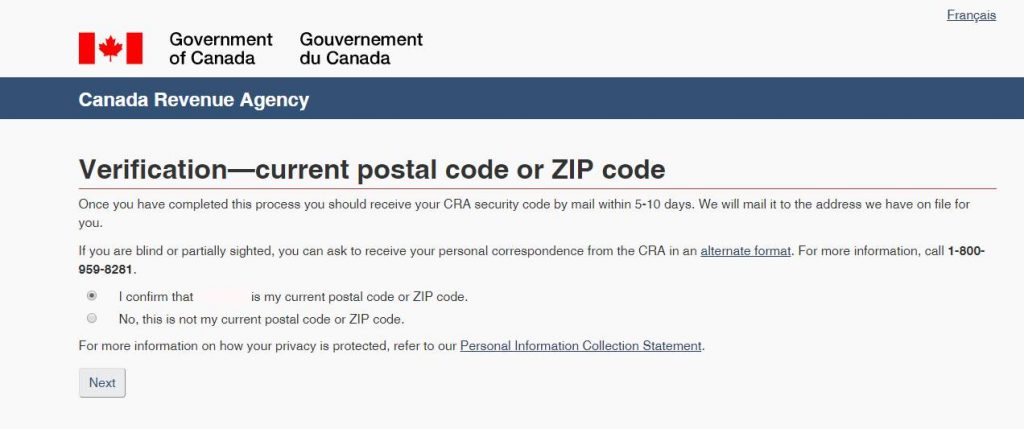

7. But, before that happens, confirm your postal code to make sure the security code arrives at the proper address:

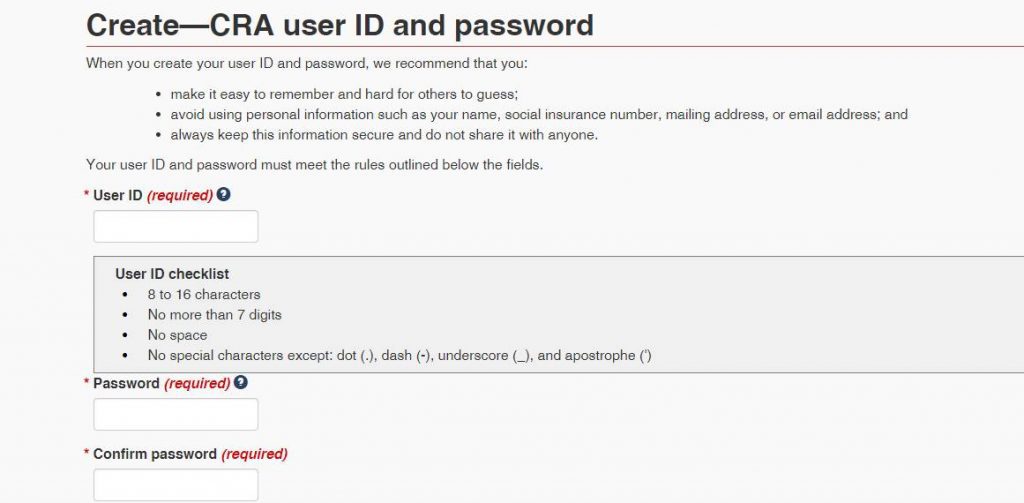

8. Next, you must create your CRA user ID and password. If you want, the site will supply you with a password that meets all of the requirements of a safe code:

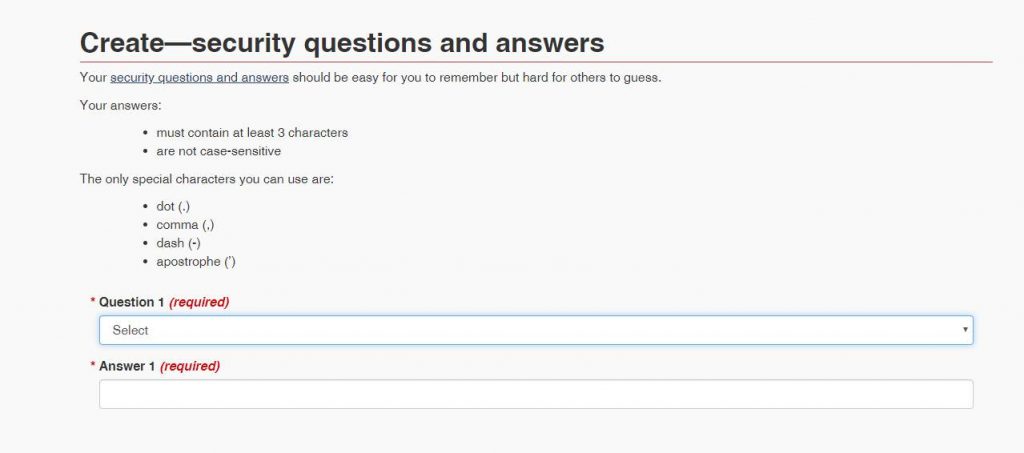

9. Then, we’re on to creating 5 security questions and answers. You will select from a variety of questions, so don’t worry about having to come up with them on your own:

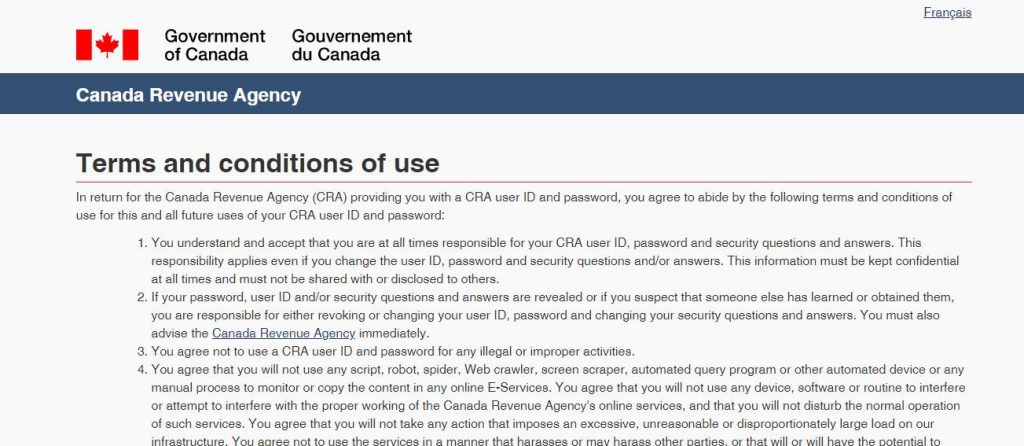

10. Agree to the Terms and Conditions of use for this and all future use of your CRA user ID and password:

11. Confirm your CRA security code notification:

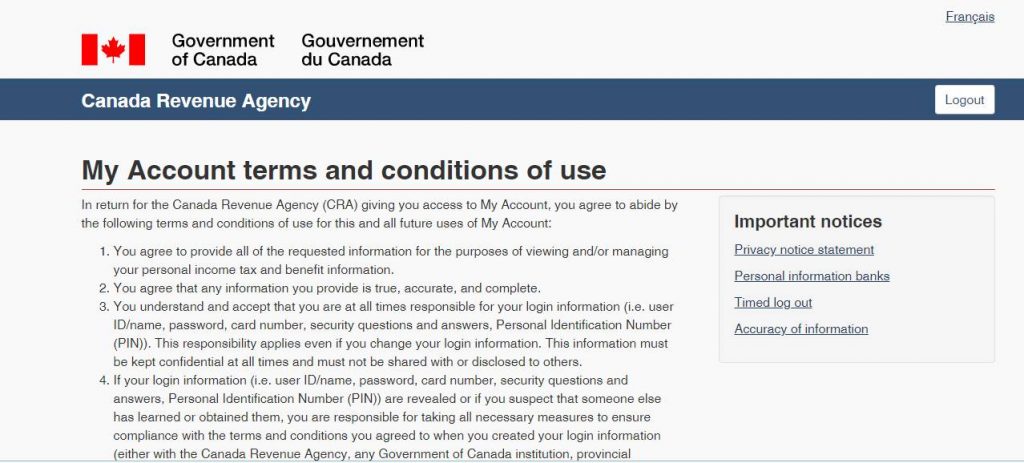

12. In order to access the “My Account” portal, you must agree to the terms and conditions of all uses of “My Account”.

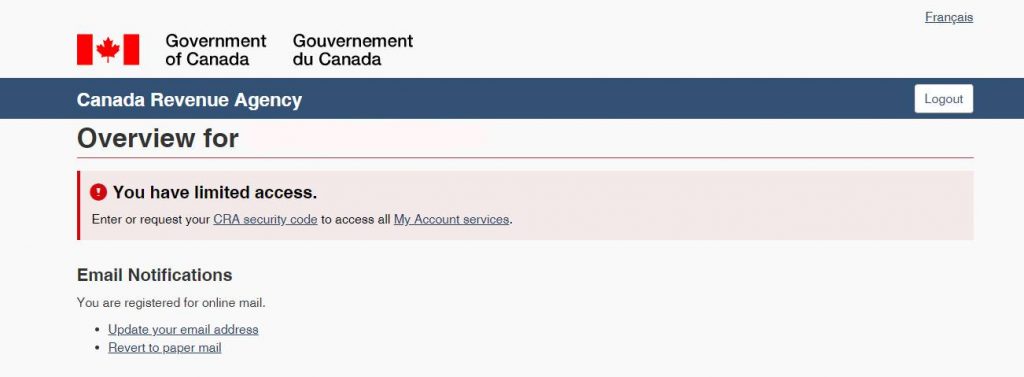

13. At this point, you will have limited access to your My Account portal. When your security code arrives, you can enter it for your all-access pass.

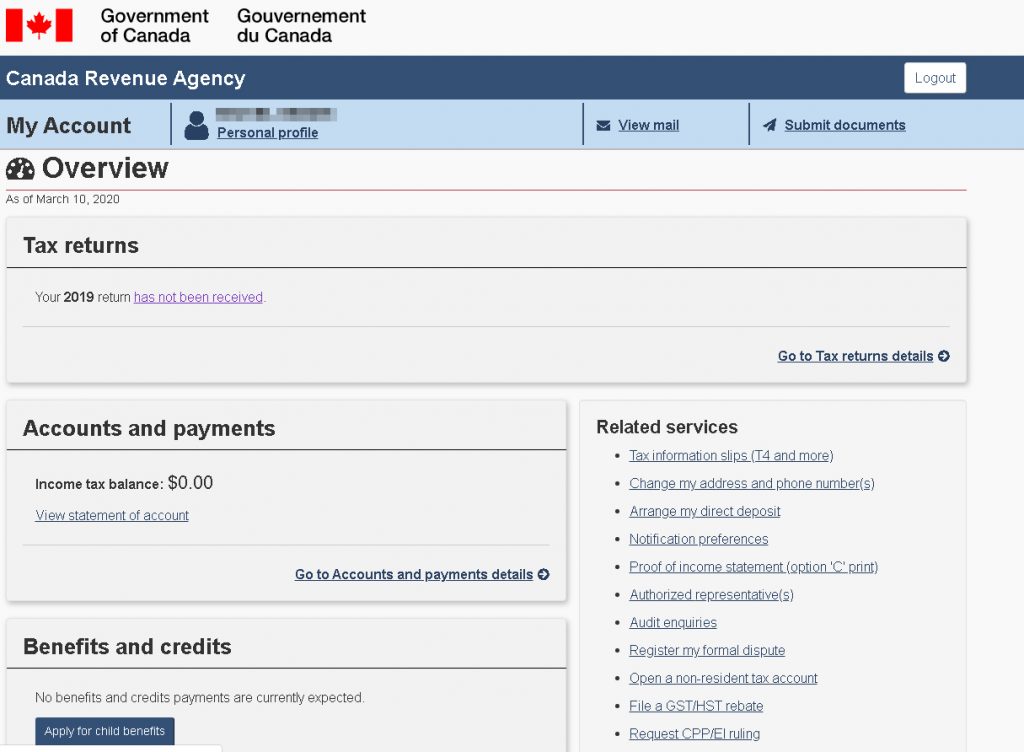

14. You’ve got your security code and have access to the Overview page of My Account? It looks like this:

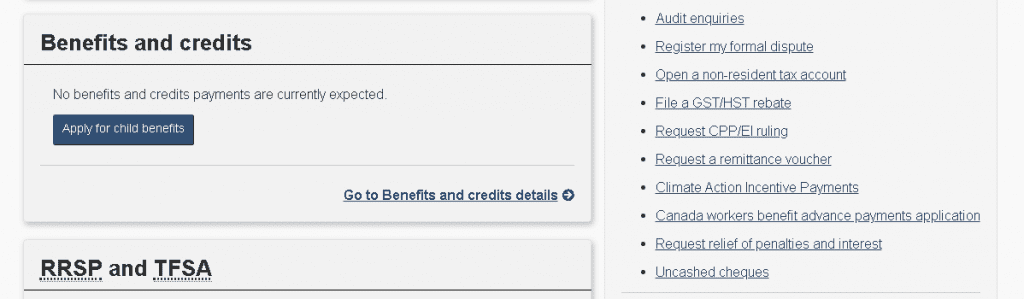

15. Scroll until you see the “Uncashed cheques” link at the bottom of “Related Services” list on the right side of your browser and then click to see this:

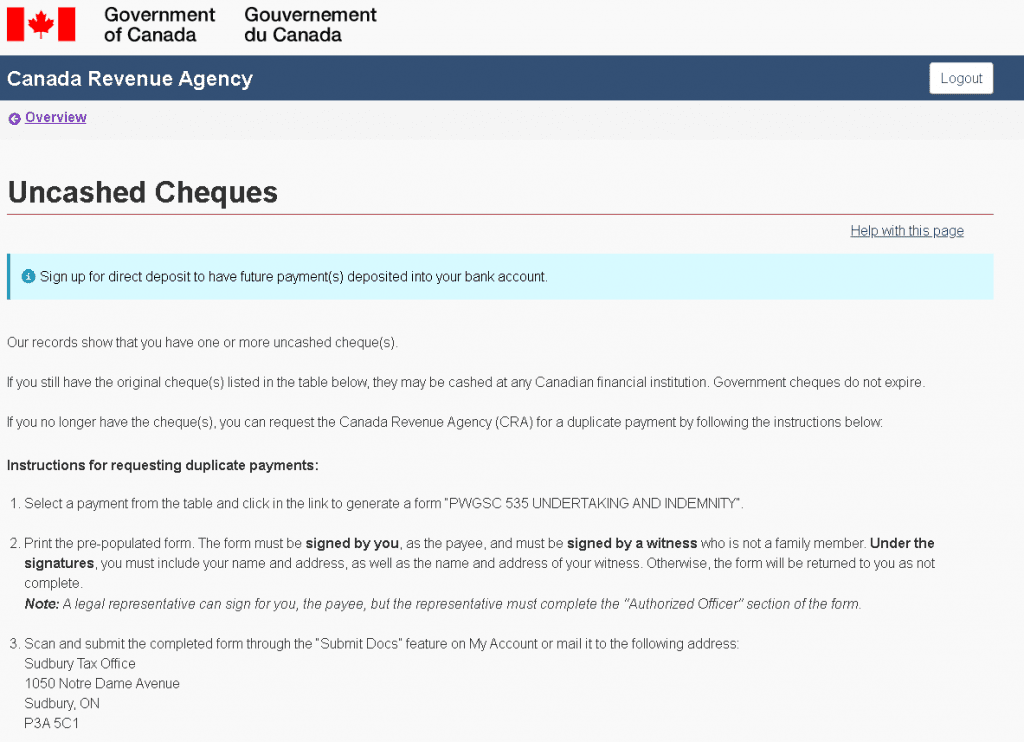

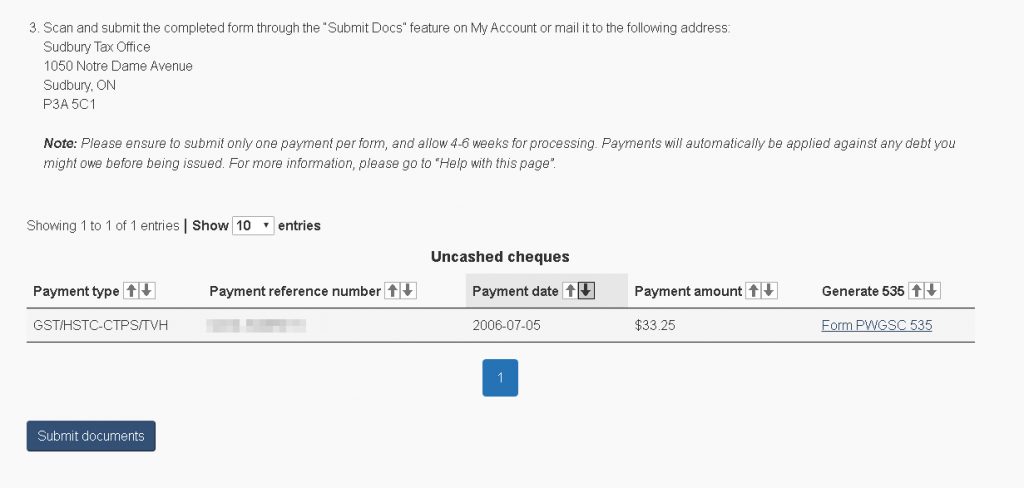

16. Scroll down until the bottom. You’ll be able to check to see if you have any cheques that have been left uncashed for six months to twenty years. If you do (!), click on the form on the right side:

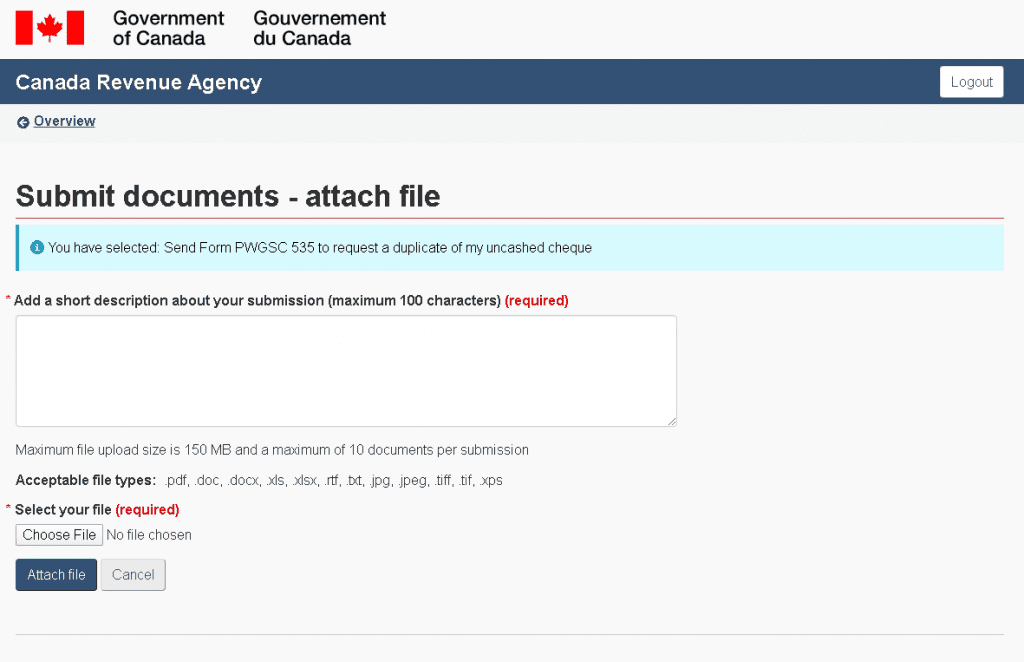

17. After you’ve filled out the secure form, attach and submit the file:

18. Be sure to submit only one payment per form, and allow 4-6 weeks for processing. Payments will be automatically applied against any debt you might owe before being issued.